Another Big F*cking Deal: The Biden Child Tax Credit

I'll never forget my senior year college sociology class.

Taught by a visiting associate Professor Rosenthal, the class, consisting largely of underclassmen and slacker seniors such as myself, was taught in a way as to deviate from the traditional college-level sociology course. There was no broad, cumbersome textbook that would set us back hundreds of dollars, but instead, we were given articles, books, and even in-class games to illustrate key concepts. At one point, we spent an entire 75-minute class playing Simpsons Monopoly to demonstrate how the game can be rigged should certain individuals get more money each time they pass go. As someone who drew the role of Mr. Burns, the wealthy industrialist, I was able to accumulate a great deal of wealth and even as my fellow players tried to cheat by combining their finances, I still owned the majority of property on the board. This was a clever example of explaining generational wealth in a way that both introduced the concept but also in a way that began to inform our own ideas about income inequality. Today's GOP would likely refer to this as part of the dangerous critical race theory but in my twenty-one-year-old brain, this was simply a valuable piece of information for me to learn ahead of my teaching career.

Even more meaningful for someone who was to be a teacher was one of the books we read that semester, Ain't No Makin' It: Leveled Aspirations in a Low-income Neighborhood by Jay MacLeod. MacLeod's book, now regarded as a classic sociology text, chronicled his experiences in an unnamed urban neighborhood in the early 1980s working with students at a local area high school. Thanks to his role as a tutor and also his athletic prowess on the basketball court, MacLeod had access to two school populations: the "Hallway Hangers" who were a group of disinterested White students who frequently ditched class and turned to drugs, and the "Brothers" who were a group of motivated African-American students who had aspirations of graduating and attending college. MacLeod found that despite these different intrinsic motivations, members of both groups ended up in the same place after three years and his conclusion was that the role of generational poverty was simply too overpowering, even in the face of an individual's own personal motivation, to overcome his or her own situation.

MacLeod's book hit home for me during my first two years in the classroom. Teaching at a low-income middle school, I too was working with students whose families were trapped in the vicious cycle of generational poverty. It made a huge difference for these students knowing that their parent or parents didn't graduate high school. There were frequent comments from students as young as twelve that education wasn't important, that their Momma or Daddy didn't graduate so why should they care what grade they got on their latest social studies test. On the opposite end, some students saw their parents as role models without a high school degree and believed that it wasn't necessary to graduate from high school for what they saw as a successful life. Either way, I saw how I was being dishonest if I were to spout off inspirational speeches about the importance of education when, in fact, my students knew how trapped they were. They were right: it didn't matter what grade they got on their social studies test. Life's deck of cards had already been unfairly stacked against them from the day they were born.

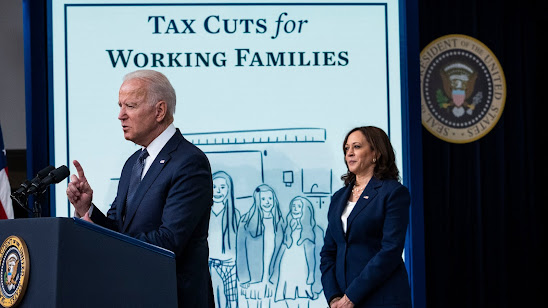

Having experienced firsthand the impact that generational poverty has on children, I cannot express how big a deal yesterday's implementation of the extended Child Tax Credit will be for millions of low-income families. The credit, as part of the American Rescue Plan, will provide between $3,000 and $3,600 per child over the next year for working families and it went out on Thursday with an estimated 35.2 million families expected to receive an instant contribution to their bank accounts. While just beginning, the impact of this new stimulus is expected to be significant with an estimated 5 million children being lifted out of poverty as a result of the tax credit. As both Vice-President Harris and President Biden mentioned during yesterday's announcement, this tax credit will potentially be both "generational" and "life-changing" to millions of American families with the potential to lift half of American children out of poverty should Congress vote to extend the program beyond this first year. Thinking back to my own teaching experience, I cannot imagine how much my former students would have benefitted from such an opportunity.

The truth is low-income families live paycheck-to-paycheck. Sacrifices are made every month when it comes to expenses. More nutritious foods are put aside for cheaper, less healthy options. Paying for an evening of childcare seems unimaginable. If a family can afford a vehicle, repairs are often put off until the last possible instant. Students are often removed from after-school clubs or tutoring and asked to take up employment to support a working parent or parents. Should unpaid utility bills pile up, families can be left literally in the dark for months at a time. Visits to a doctor are often seen as a last resort due to escalating healthcare costs, especially for those who are uninsured. For a family experiencing any of these challenges, an extra few thousand dollars may very well change the course for that family and it may very well change the course for those children in the household. That extra money could literally be the difference between life and death.

But that's what Democrats do. That's who they are. They understand the complexities of generational poverty. Like Professor Rosenthal, they know the impact of these policies and they know the challenges faced by low-income families, especially those of color. And Democrats address those challenges head-on. For four years, we didn't hear a peep from Republicans about generational poverty not because they weren't aware of it but because they wanted to maintain it. Trump loved the uneducated and nothing keeps people more uneducated than being denied the ability to move up into the middle-class. Republicans will call the tax credit big government spending and will inevitably claim it's just the latest handout from Democrats in an attempt to win votes. But deep down inside, Republicans are terrified because this shows that government can serve the most vulnerable among us when compassionate people are in charge. And if the government can help in this way, why didn't it help when Republicans were in charge?

In November of 2020, Americans voted for compassion. For empathy. For an understanding that we are all in this together. In just 6 short months, we have seen the Biden-Harris Administration demonstrate these qualities through the legislation it has passed. The extended Child Tax Credit is the latest example of what happens when smart, competent, compassionate Democrats have access to the reins of government. Not a single Republican voted for the Child Tax Credit because not a single Republican voted for the American Rescue Plan. But they will take credit for it. We know it. We know it because the tax credit will prove to be both massively popular and massively successful. Because, as we know, Republican parents get that tax credit too! At the end of the day, it must be emphasized that this was a Democratic initiative. It was Democrats who took on generational poverty. And it was Democrats who delivered direct financial aid to those who needed it the most.

Shout this from the rooftops from now until November 2022.